- Home

- About

- Benefits & Services

- State Veterans Homes

- Nevada Veterans Memorial Cemeteries

- Community

- News

- Suicide Prevention

- Opioid Prevention

- Donate

- Fallen Heroes

- Nevada’s Veterans Memorials

- Calendar/Events

- Nevada Transition Assistance Program (NVTAP)

Benefit Category: Federal

The VA provides a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms.

Visit the VA Home Loan website for more information. Instructional videos on the Home Loan program are also available.

You must have suitable credit, sufficient income, and a valid Certificate of Eligibility (COE) to be eligible for a VA-guaranteed home loan. The home must be for your own personal occupancy. The eligibility requirements to obtain a COE are listed below for Servicemembers and Veterans, spouses, and other eligible beneficiaries.

VA home loans can be used to:

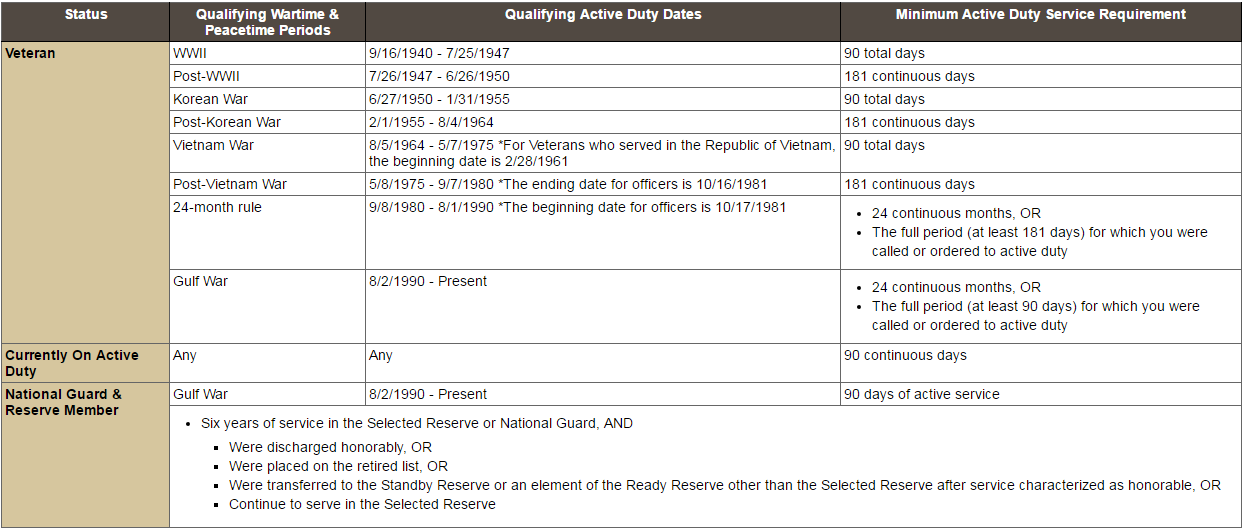

To obtain a COE, you must have been discharged under conditions other than dishonorable and meet the service requirements below:

*If you do not meet the minimum service requirements, you may still be eligible if you were discharged due to (1) hardship, (2) the convenience of the government, (3) reduction-in-force, (4) certain medical conditions, or (5) a service-connected disability.

The spouse of a Veteran can also apply for home loan eligibility under one of the following conditions:

You may also apply for eligibility if you fall into one of the following categories:

Veterans can have previously-used entitlement “restored" to purchase another home with a VA loan if:

The US Department of Veterans Affairs urges all veterans who are encountering problems making their mortgage payments to speak with their servicers as soon as possible to explore options to avoid foreclosure. Contrary to popular opinion, servicers really do not want to foreclose because foreclosure costs a lot of money. Depending on a veteran’s specific situation, servicers may offer any of the following options to avoid foreclosure:

Contact your Regional Loan Center for information and assistance. View the video series “VA Alternatives to Foreclosure" for more information.

The Phoenix Regional Loan Center services the following states: Arizona, California, New Mexico and Nevada. They can be contacted at:

Phoenix Regional Loan Center

U.S. Department of Veterans Affairs

3333 North Central Ave.

Phoenix, AZ 85012

Hours of Operation: Open to the public 7:30 a.m.–4 p.m. Mountain Standard Time (MST)

Phone: 1-888-869-0194

For more information and for a VA Housing Benefit guide, feel free to check out the following websites at:

http://www.moneygeek.com/mortgage/resources/veterans-benefits-for-housing-guide/